Understanding Medicare iRMMA Surcharges

Medicare Part B and Part D IRMAA

The income-related monthly adjustment amount, or IRMAA, is a surcharge that high-income people may pay in addition to their Medicare Part B and Part D premiums. In the Bay Area, it’s not uncommon for people to have this IRMAA surcharge applied to their Medicare premiums because we have higher incomes than many places in the country. I know it doesn’t seem fair because our cost of living is much higher too. I don’t make the rules, I just relay them.

The Social Security Administration determines whether you’re subject to IRMAA based on your income reported on your tax return from two years ago. For example, your 2023 premiums are based on your 2021 tax return, assuming you have already filed your 2021 return. The IRMAA is calculated and adjusted each year. For Part B IRMAA, Social Security collects this amount directly, either by deduction from your Social Security check, or by invoicing you directly.

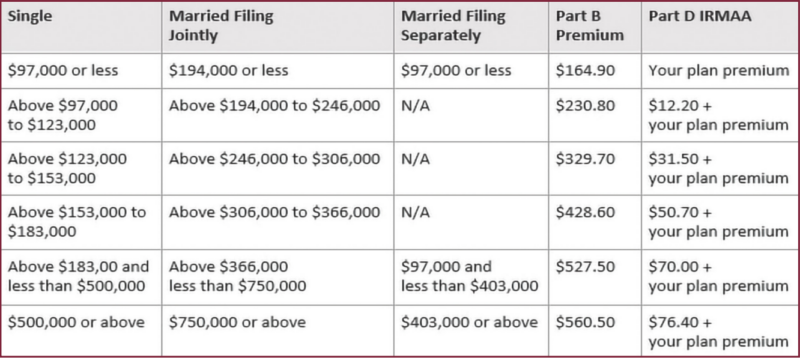

The income brackets that Social Security uses to determine the IRMAA are as follows:

What if you don’t agree with the number they calculate or if

you no longer make this amount?

It is not uncommon to make less money after you retire, so if Social Security is charging you based on your previous employment amount, you can appeal their decision and have them review your account to lower the IRMAA. Many of our clients have been able to get their amounts adjusted to the standard rate or a lower bracket after retiring. On the letter they provide you, they advise you where to call to appeal it. You can always call your local Social Security office.

IRMAA on Part D premiums are typically collected by the Part D insurance carrier, not by Social Security. They will add the amount to your Part D premium.

If you are confused by this information, you are not alone! So many folks coming into the Medicare system are very confused by all this information. After all, it’s new to you, so don’t be so hard on yourself.

Medicare Webinars